|

| Volume 1, Issue 6 |

6th February

1998 |

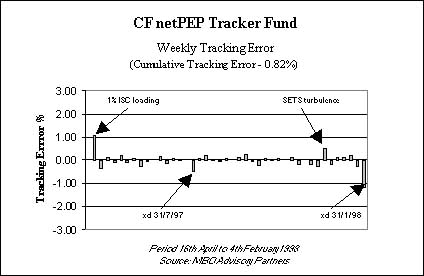

| Performance

since netPEP was launched.

| MAJOR INDEX

PERFORMANCES |

% growth

1 month |

% growth

3 months |

% growth

6 months |

% growth

12 months |

| FTSE 100 |

5.06% |

2.71% |

24.72% |

28.34% |

| FTSE 350 Share |

4.60% |

1.57% |

19.41% |

20.75% |

| FTSE All Share

Index |

4.51% |

1.69% |

20.11% |

22.65% |

| FTSE Mid 250 |

2.64% |

-1.85% |

6.66% |

5.21% |

| FTSE SmallCap |

3.13% |

-1.71% |

2.94% |

3.44% |

| Bid to

bid price gross income reinvested - all

periods to 21st January 1998

Source: Reuters Hindsight |

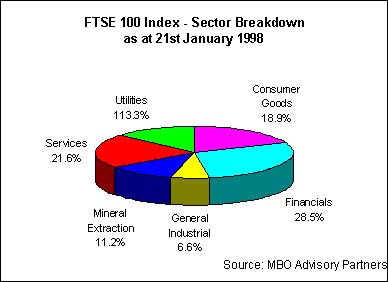

LEADERS AND LAGGARDS

| BEST

BY SECTOR |

|

performance |

%

of Index |

| Zeneca

Group |

Consumer

Goods |

15.66% |

2.42 |

| Sun

Life & Provincial |

Financials |

19.54% |

0.47 |

| Tomkins |

General

Industrial |

10.58% |

0.36 |

| RTZ |

Mineral

Extraction |

5.68% |

0.84 |

| Rentokill

Initial |

Services |

15.02% |

0.91 |

| Centrica |

Utilities |

16.11% |

0.46 |

| |

|

|

|

| WORST

BY SECTOR |

|

performance |

%

of Index |

| Unilever |

Consumer

Goods |

-4.38% |

1.68 |

| Standard

Chartered |

Financials |

-17.22% |

0.47 |

| Rolls

Royce |

General

Industrial |

-16.91% |

0.28 |

| Shell

Transport |

Mineral

Extraction |

-11.15% |

4.35 |

| Dixons |

Services |

-20.15% |

0.22 |

| Cable

& Wireless |

Utilities |

-5.40% |

1.18 |

| Period:

19th December 1997 to 21st January 1998

Source: MBO Advisory Partners |

|

| |

|